|

Metaphors are

important even if they remain unstated. The modern conception of an

economy is dominated by the theory of neoclassical economics, whose

metaphor is hidden from view for a very good reason: the field would

look ridiculous if its roots were front and center. But in the

spirit of “Know the truth and it will set you free”, your humble

correspondent will attempt to lay bare the foundation of

neoclassical economics, and, after having done so, propose a more

rational view of economic systems. Metaphors are

important even if they remain unstated. The modern conception of an

economy is dominated by the theory of neoclassical economics, whose

metaphor is hidden from view for a very good reason: the field would

look ridiculous if its roots were front and center. But in the

spirit of “Know the truth and it will set you free”, your humble

correspondent will attempt to lay bare the foundation of

neoclassical economics, and, after having done so, propose a more

rational view of economic systems.

More

heat than light More

heat than light

The grand view of life on which neoclassical economics is based

is as a system of pipes filled with gas or water. In fact, one of

the giants of economics early in the 20th century, Irving Fisher of

Yale, actually constructed a model of the economy which was

simulated by a miniature plumbing system; his mentor was one of the

pioneers of statistical mechanics. The reason for this peculiar

metaphor is that such a conception allows for economists to excel in

the application of the mathematical techniques used by physicists,

and in particular, the methods of statistical mechanics.

Much of modern neoclassical economics is based on the work of a

French engineer Leon Walras. His General Equilibrium Theory is so

important that most economic work must pass the test of being

compatible with his theory. Walras, who wrote in the late 19th

century, was fascinated by the reigning scientific theory of the

day, statistical mechanics (he is said to have kept a copy of a

mechanics textbook next to his bed at night).[1] Even though Darwin had finally

published his work on evolution, the “big thing” in science was

physics, and the big thing in physics, besides the burgeoning field

of electrical science, was statistical mechanics.

Classical mechanics, developed by Isaac Newton, dealt with the

interaction of two bodies with each other; it would take until far

into the 20th century to use Newton’s theory to understand the

interaction of even three bodies (i.e. “three body

problem), and even now the math is very difficult. The beauty of

statistical mechanics is that it is possible to deal with very large

quantities of elements in a statistical manner, using linear algebra

and systems of equations, and thereby predict the behavior of fluids

such as water and gases such as air, which are made up of billions

of molecules.

There are three main properties of a system that can be

successfully addressed by statistical mechanics:

1) There are a large amount of elements;

2) the elements are all the same (homogenous), and therefore,

no element or set of elements serves a particular function; and

3) elements are not created, destroyed or changed into other

kinds of elements, but stay constant.

Just so, a competitive industry has many firms, they are assumed

to be all the same, and though firms go into and out of existence,

the capital that they use to produce their goods is assumed to be

constant, and technology is assumed not to change. No set of firms

serves any specific function.

Neoclassical economics is able to use very powerful analytical

tools for explaining behavior within competitive industrial sectors

with no technological change. These analytical techniques are very

effective in the short-term; calculus, after all, is a way to

understand forces instantaneously, that is, practically without

reference to time. In the grand scheme of general equilibrium

theory, prices are all determined according to the various supply

and demand factors spread throughout the economy, and prices are

determined instantaneously. Time does not exist, technological

change does not exist, and perhaps most surprisingly, capital, or at

least fixed capital,[2] does not exist.

Capital illiteracy

The existence of capital has always been a big problem in the

field of economics. The “problem” with capital is that it makes more

of itself – in other words, it breaks the assumptions of statistical

mechanics, that elements are not created or destroyed.[3] Capital reproduces itself –

sort of like living things within ecosystems, in fact. Capital

therefore inherently creates positive feedback loops – that is, the

increase of something increases the chances that the thing will

increase even further. But if you put positive feedback loops into a

system of fluids or gases, you get what is called turbulence – and

thus was born the field of “chaos” theory, or more properly,

nonlinear dynamics, within the fields of physics and chemistry. But

neoclassical economics is definitely not amenable to positive

feedback loops.[4] And so, if the choice is

between throwing out neoclassical economic theory or capital, the

choice is obvious – capital, be gone!

Thus, economists

- can’t explain economic growth,

- can’t integrate capital or technological innovation into

their models, and

- can’t explain how the various industries in an economy fit

together.

Other than that, it’s a great theory. It can explain how and why

prices change, within a particular competitive industry, in a very

short period of time.

As luck would have it, just as neoclassical economics was

solidifying by using the cutting-edge of physics, physics passed

economics by and embarked on the great period of the elaboration of

the theories of relativity and quantum physics. By the late 20th

century, biology had surpassed physics as the most important science

– in other words, it got more funding – and ecosystem and

evolutionary theory could not only incorporate phenomena like

reproduction, change, and growth, these concepts became the very

core of these sciences.

Metaphor Evolution

Ecosystems

are not conceived of as a set of similar elements, they are modeled

as a set of functional niches, a set of elements including climate,

landscape, plants, animals or fungi, set within a complex whole. The

pieces all fit together. There are not a large enough number of

niches to enable the use of statistical methods. The largest

aggregation of niches in an ecosystem are called trophic levels,

which is a fancy way of saying that plants produce the main biomass

of an ecosystem; herbivores (mainly) consume what the plants

produce; and carnivores consume the herbivores (sometimes called

secondary consumers). Finally, there are the detrivores such as

worms, fungi and bacteria that break down the dead plant and animal

life, and make the released resources available to the producers in

the form of soil. Within each level there may be greater detail,

such as the various parts of a tree, or depths in a lake or ocean,

and these are considered separate niches. Ecosystems

are not conceived of as a set of similar elements, they are modeled

as a set of functional niches, a set of elements including climate,

landscape, plants, animals or fungi, set within a complex whole. The

pieces all fit together. There are not a large enough number of

niches to enable the use of statistical methods. The largest

aggregation of niches in an ecosystem are called trophic levels,

which is a fancy way of saying that plants produce the main biomass

of an ecosystem; herbivores (mainly) consume what the plants

produce; and carnivores consume the herbivores (sometimes called

secondary consumers). Finally, there are the detrivores such as

worms, fungi and bacteria that break down the dead plant and animal

life, and make the released resources available to the producers in

the form of soil. Within each level there may be greater detail,

such as the various parts of a tree, or depths in a lake or ocean,

and these are considered separate niches.

The species within a niche may change in the process of

evolution, but the niche endures; the niches may eventually be

reconfigured, but the ecosystem is sustained. Scientists studying

the dynamics of ecosystems and species change do not dismiss change

as in neoclassical economics, they spend most of their time trying

to understand it.

Each

niche serves a particular function, and if enough of these functions

collapse, the entire ecosystem will collapse. For instance, at one

point killer whales had eliminated most sea otters from parts of the

pacific northwest. Without sea otters to eat them, the sea urchin

population exploded, almost eliminating the kelp forests that were

critical to the survival of most species. Only by bringing the sea

otter back from the brink was the ecosystem saved. E.O. Wilson calls

species such as the sea otter a keystone species,

because some species are very central to the functioning of an

ecosystem.[5] For similar reasons, wolves

have been reintroduced in parts of the American west, in order to

keep deer under control that would otherwise devastate plant

niches . Each

niche serves a particular function, and if enough of these functions

collapse, the entire ecosystem will collapse. For instance, at one

point killer whales had eliminated most sea otters from parts of the

pacific northwest. Without sea otters to eat them, the sea urchin

population exploded, almost eliminating the kelp forests that were

critical to the survival of most species. Only by bringing the sea

otter back from the brink was the ecosystem saved. E.O. Wilson calls

species such as the sea otter a keystone species,

because some species are very central to the functioning of an

ecosystem.[5] For similar reasons, wolves

have been reintroduced in parts of the American west, in order to

keep deer under control that would otherwise devastate plant

niches .

Neoclassical economics cannot admit of concepts such as keystone

species or self-reinforcing change or structure based on function.

As I have argued on this site, manufacturing is an absolutely

essential part of a modern wealthy economy. Manufacturing, it might

be said, is like a keystone species. Without the functionality of

manufacturing, the economy collapses. Manufacturing is actually more

like a trophic level, that is, it is the main production subsystem

of the larger system known as the economy. What is produced is then

distributed, in what we may call a distribution system. In the

distribution system of the economy we find retail, wholesale,

services such as advertising, and perhaps most importantly, finance,

which redirects the surplus generated by the production system.

Services are almost always produced using or servicing goods, so

the service sector of an economy may be seen as a level that both

“consumes” (or uses) manufactured goods and produces services.

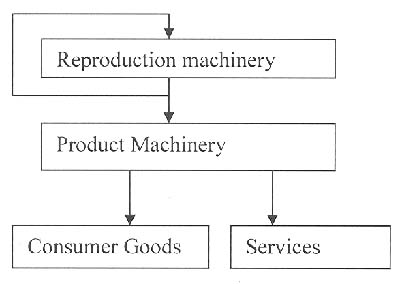

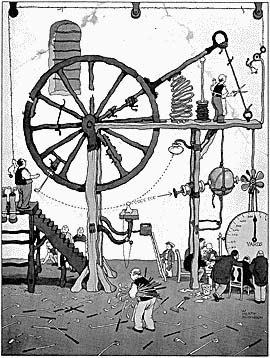

Within manufacturing we can identify three further levels, or

stages. The outermost stage is the arena of the production of

consumer goods, such as cars or clothes. In order to create these

consumer goods, production machinery must be produced; it is the

production machinery that is used within a factory or construction

site that makes consumer goods possible.

Finally, at the very center of the production system we have what

I have called “reproduction machinery”, machines such as machine

tools, steel-making machinery, electricity-producing turbines, and

semiconductor-making machinery, that both make more of themselves

and produce production machinery. Unlike General Equilibrium Theory,

fixed capital – machinery, essentially – is at the heart of the

economic system.

Without all of these levels – distribution, services, consumer

goods, production machinery, and reproduction machinery – a modern,

wealthy economy would not be possible. The economy is an ecosystem,

not a system of pipes.

Metaphor

Metaphysics Metaphor

Metaphysics

Each of these levels of production can also be divided into a

category of production – a way of looking at each level to see what

functions are served by various kinds of goods. For instance,

steel-making machinery is the most important way of creating a

material. Creating a material – steel, cloth, wood, plastic – is

essential to any manufacturing system. So a

material-making function is a critical function. Once

we have a material, that material must be shaped into something

useful – an axle, wood part in a piece of furniture, shape of cloth

– which is done by certain types of machinery, such as machine

tools, woodworking machinery, or textile machinery. Just as the

Greeks discussed form and content, so it is useful to talk about a

structure-forming category of production and a

material-making category of production. Metaphysics is also

MetaEngineering.

In order to create form and content, we need two other categories

of production – information-processing and energy

conversion . The “computer revolution”, and more recently, the

internet boom, has contributed greatly to the productivity of

manufacturing, in addition to retailing and searching. Without the

widespread use of electricity, we would have a much lower standard

of living, because manufacturing would be a much more difficult

thing to do.

However, it is in the energy category in particular that we find,

shall we say, a certain difficulty: fossil fuels come from outside

the production system. Oil, coal, and natural gas exploration,

extraction, and refining are among the most sophisticated

manufacturing technologies yet developed, and most fossil fuels

would not be usable without them; the reason fossil fuels are used

and valued is because they power machinery. However, the fossil

fuels themselves come from the Earth

Towards a modern energy sector

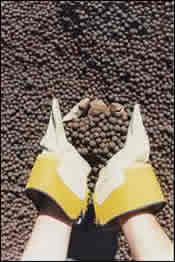

Ideally,

the raw materials of an industrial system should be almost free.

Iron and silicon, the basis of steel and semiconductors, are both

very abundant in the Earth’s crust. The category of material-making

is often very dependent on much scarcer materials, however. As the

recent rise in commodity prices indicates, we are coming to the end

of the period when raw materials were cheap and easy to find.

Indeed, considering that mining is one of the most environmentally

destructive activities known to man or nature,[6] the true costs of raw materials

has never been ascertained by the market. However, we are now at the

point that most steel is being recycled, and it should be possible

to provide for most if not all raw materials through recycling from

now on. Ideally,

the raw materials of an industrial system should be almost free.

Iron and silicon, the basis of steel and semiconductors, are both

very abundant in the Earth’s crust. The category of material-making

is often very dependent on much scarcer materials, however. As the

recent rise in commodity prices indicates, we are coming to the end

of the period when raw materials were cheap and easy to find.

Indeed, considering that mining is one of the most environmentally

destructive activities known to man or nature,[6] the true costs of raw materials

has never been ascertained by the market. However, we are now at the

point that most steel is being recycled, and it should be possible

to provide for most if not all raw materials through recycling from

now on.

Fossil fuels, on the other hand, can’t even be recycled. Assuming

that replacing them with biofuels is problematic, the obvious

solution is truly renewable energy, that is, using wind, solar

power, and geothermal and water power as the energy source, and

constructing machinery to capture these sources of energy. Humans

should concentrate on what they are good at, creating machinery, not

what they are bad at, managing resources.

Because the energy sector, and to a lesser extent, the materials

sector, are using up their own supply, the current global economic

system is heading for collapse, just as any ecosystem that is using

up the basis for its production would eventually collapse. Collapse

is different than catastrophe, or as it has been termed in the

literature, “release”;[7] forest fires are part of the

forest’s natural cycle, and indeed the forest ecosystem is dependent

on occasional fires. Even a meteor hitting the Earth 65 million

years ago wiped out niches that mammals, and eventually humans, were

able to fill. But at least in the time period of centuries, when a

formerly lush area turns to desert or rock, we may consider this as

more or less a permanent collapse. And when an economy is based on

fossil fuels then the disappearance of fossil fuels will mean the

collapse of the industrial economic ecosystem.

Phoenix

Phoenix

This collapse is a distinct possibility because humans have not

learned to turn their industrial system into a cycle, as natural

ecosystems do. The least heralded trophic level, the function served

by the detrivores, has not been taken seriously. Even in beginning

ecology lessons this literally lowly level may be ignored. But

besides the natural solar energy, water, carbon, and nitrogen

cycles, the detrivores provide the raw material on which ecosystems

depend. Perhaps the meek shall yet inherit the earth, because worms

certainly create the earth.

The sustainable mode of production

Karl Marx famously predicted that a socialist mode of production

would follow a capitalist mode of production. He based his

historical progression on the relations of production, basically

from slavery to capitalism to socialism. As I have argued in “Why

a Democratic Economy would be a more efficient economy”, an

essential characteristic of an efficient economy would be to create

a society in which firms were operated and owned by their employees.

But this would be one part of a wider transformation to a

sustainable mode of production.

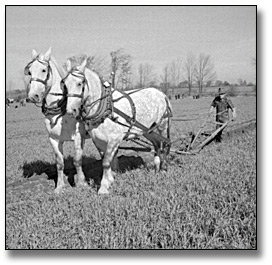

I ndeed,

as Dale Allen Pfeiffer points out in “Eating fossil fuels”, the main

mode of production before fossil fuels was one of

slavery, because without fossil fuels slavery is perhaps the only

way to coax enough industrial energy out of humans to make

industrial processes work. Perhaps Max Weber is partly correct to

write of the capitalist spirit of Protestantism, and perhaps Marx is

partly correct to explain the premodern precursors of capitalism.

But capitalism was also made possible by fossil fuels because it

made it possible to free up most human labor from what had

previously been the need to provide the basic energy for the

economic system. By 1870, when both American slavery and Russian

serfdom had been destroyed, the fossil-fuel based industrial system

was taking off. It is therefore scary to contemplate what mode of

production might follow the decline and fall of fossil fuels, unless

the industrial system becomes truly sustainable. ndeed,

as Dale Allen Pfeiffer points out in “Eating fossil fuels”, the main

mode of production before fossil fuels was one of

slavery, because without fossil fuels slavery is perhaps the only

way to coax enough industrial energy out of humans to make

industrial processes work. Perhaps Max Weber is partly correct to

write of the capitalist spirit of Protestantism, and perhaps Marx is

partly correct to explain the premodern precursors of capitalism.

But capitalism was also made possible by fossil fuels because it

made it possible to free up most human labor from what had

previously been the need to provide the basic energy for the

economic system. By 1870, when both American slavery and Russian

serfdom had been destroyed, the fossil-fuel based industrial system

was taking off. It is therefore scary to contemplate what mode of

production might follow the decline and fall of fossil fuels, unless

the industrial system becomes truly sustainable.

There is a long history of the discussion of the ideas of man vs.

nature, or man outside of nature, or man in nature. The first and

second views (held by Marx, by the way), are breathtakingly ignorant

(the more polite label is “cornucopian”). Obviously, if you run out

of something, you can’t make anything that depends on that

something. Or if you destroy the ecosystems that you depend on for

your agriculture and cities, you can’t survive.

But even the third view, that man is a part of nature, has tended

not to view the industrial economy as being part of nature. Of

course, the industrial economy has been the great destroyer of

ecosystems, but this doesn’t mean that an industrial economy is not

part of the ecosystem. After all, a volcano is part of the ecosystem

(although in the long run volcanoes are responsible for much of the

raw material of ecosystems, unlike industrial economies, which turn

useful ecological material into useless ecological poisons).

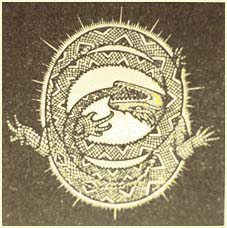

The preindustrial, indigenous peoples of the earth usually

managed to live in relative harmony with their ecosystems. If the

industrial ecosystem can manage to change from a linear sequence of

mining, processing, and polluting, to a circular system of

processing and recycling, if the snake can grab its own tail, to use

a Native American image, then perhaps humanity can tread the Earth

lightly, even with six billion people.

You can contact Jon Rynn directly on his jonrynn.blogspot.com .

You can also find old blog entries and longer articles at

economicreconstruction.com. Please feel free to reach him at

This email address is being protected from spam bots, you need

Javascript enabled to view it

.

[1] The classic work on the

statistical mechanical nature of economics is Philip Mirowski’s

More heat than light , Cambridge University Press, 1989, from

which many of the ideas of the first paragraphs were taken.

[2] Fixed capital was

defined initially by Adam Smith as, basically, the means of

production, that is, the plant and machinery that was fixed and used

to make more wealth. Circulating capital, according to Smith, are

the intermediate goods that exist within the market before the goods

turn into final goods. Circulating capital, not fixed capital, is

represented in the general equilibrium model.

[3] Joseph Schumpeter’s

phrase, “creative destruction”, is constantly thrown around by

economists, but it is the only major concept of his that they use,

and it does not pervade the conceptual core of economics, which we

are concerned with here.

[4] For a more detailed

discussion of the problems of economics, growth, and capital, see my

dissertation chapter on the subject, available at the following link

.

[5] E. O. Wilson, The

Diversity of Life , 1999.

[6] J. R. McNeill,

Something New Under the Sun; an environmental history of the 20th

century , 2001.

[7] Gunderson and Holling,

Panarchy: Understanding transformations in human and natural

systems , 2001.

This email address is being protected from spam bots, you need

Javascript enabled to view it

|

Metaphors are

important even if they remain unstated. The modern conception of an

economy is dominated by the theory of neoclassical economics, whose

metaphor is hidden from view for a very good reason: the field would

look ridiculous if its roots were front and center. But in the

spirit of “Know the truth and it will set you free”, your humble

correspondent will attempt to lay bare the foundation of

neoclassical economics, and, after having done so, propose a more

rational view of economic systems.

Metaphors are

important even if they remain unstated. The modern conception of an

economy is dominated by the theory of neoclassical economics, whose

metaphor is hidden from view for a very good reason: the field would

look ridiculous if its roots were front and center. But in the

spirit of “Know the truth and it will set you free”, your humble

correspondent will attempt to lay bare the foundation of

neoclassical economics, and, after having done so, propose a more

rational view of economic systems. More

heat than light

More

heat than light Ecosystems

are not conceived of as a set of similar elements, they are modeled

as a set of functional niches, a set of elements including climate,

landscape, plants, animals or fungi, set within a complex whole. The

pieces all fit together. There are not a large enough number of

niches to enable the use of statistical methods. The largest

aggregation of niches in an ecosystem are called trophic levels,

which is a fancy way of saying that plants produce the main biomass

of an ecosystem; herbivores (mainly) consume what the plants

produce; and carnivores consume the herbivores (sometimes called

secondary consumers). Finally, there are the detrivores such as

worms, fungi and bacteria that break down the dead plant and animal

life, and make the released resources available to the producers in

the form of soil. Within each level there may be greater detail,

such as the various parts of a tree, or depths in a lake or ocean,

and these are considered separate niches.

Ecosystems

are not conceived of as a set of similar elements, they are modeled

as a set of functional niches, a set of elements including climate,

landscape, plants, animals or fungi, set within a complex whole. The

pieces all fit together. There are not a large enough number of

niches to enable the use of statistical methods. The largest

aggregation of niches in an ecosystem are called trophic levels,

which is a fancy way of saying that plants produce the main biomass

of an ecosystem; herbivores (mainly) consume what the plants

produce; and carnivores consume the herbivores (sometimes called

secondary consumers). Finally, there are the detrivores such as

worms, fungi and bacteria that break down the dead plant and animal

life, and make the released resources available to the producers in

the form of soil. Within each level there may be greater detail,

such as the various parts of a tree, or depths in a lake or ocean,

and these are considered separate niches.  Each

niche serves a particular function, and if enough of these functions

collapse, the entire ecosystem will collapse. For instance, at one

point killer whales had eliminated most sea otters from parts of the

pacific northwest. Without sea otters to eat them, the sea urchin

population exploded, almost eliminating the kelp forests that were

critical to the survival of most species. Only by bringing the sea

otter back from the brink was the ecosystem saved. E.O. Wilson calls

species such as the sea otter a keystone species,

because some species are very central to the functioning of an

ecosystem.

Each

niche serves a particular function, and if enough of these functions

collapse, the entire ecosystem will collapse. For instance, at one

point killer whales had eliminated most sea otters from parts of the

pacific northwest. Without sea otters to eat them, the sea urchin

population exploded, almost eliminating the kelp forests that were

critical to the survival of most species. Only by bringing the sea

otter back from the brink was the ecosystem saved. E.O. Wilson calls

species such as the sea otter a keystone species,

because some species are very central to the functioning of an

ecosystem.

Metaphor

Metaphysics

Metaphor

Metaphysics Ideally,

the raw materials of an industrial system should be almost free.

Iron and silicon, the basis of steel and semiconductors, are both

very abundant in the Earth’s crust. The category of material-making

is often very dependent on much scarcer materials, however. As the

recent rise in commodity prices indicates, we are coming to the end

of the period when raw materials were cheap and easy to find.

Indeed, considering that mining is one of the most environmentally

destructive activities known to man or nature,

Ideally,

the raw materials of an industrial system should be almost free.

Iron and silicon, the basis of steel and semiconductors, are both

very abundant in the Earth’s crust. The category of material-making

is often very dependent on much scarcer materials, however. As the

recent rise in commodity prices indicates, we are coming to the end

of the period when raw materials were cheap and easy to find.

Indeed, considering that mining is one of the most environmentally

destructive activities known to man or nature,

ndeed,

as Dale Allen Pfeiffer points out in “Eating fossil fuels”, the main

mode of production before fossil fuels was one of

slavery, because without fossil fuels slavery is perhaps the only

way to coax enough industrial energy out of humans to make

industrial processes work. Perhaps Max Weber is partly correct to

write of the capitalist spirit of Protestantism, and perhaps Marx is

partly correct to explain the premodern precursors of capitalism.

But capitalism was also made possible by fossil fuels because it

made it possible to free up most human labor from what had

previously been the need to provide the basic energy for the

economic system. By 1870, when both American slavery and Russian

serfdom had been destroyed, the fossil-fuel based industrial system

was taking off. It is therefore scary to contemplate what mode of

production might follow the decline and fall of fossil fuels, unless

the industrial system becomes truly sustainable.

ndeed,

as Dale Allen Pfeiffer points out in “Eating fossil fuels”, the main

mode of production before fossil fuels was one of

slavery, because without fossil fuels slavery is perhaps the only

way to coax enough industrial energy out of humans to make

industrial processes work. Perhaps Max Weber is partly correct to

write of the capitalist spirit of Protestantism, and perhaps Marx is

partly correct to explain the premodern precursors of capitalism.

But capitalism was also made possible by fossil fuels because it

made it possible to free up most human labor from what had

previously been the need to provide the basic energy for the

economic system. By 1870, when both American slavery and Russian

serfdom had been destroyed, the fossil-fuel based industrial system

was taking off. It is therefore scary to contemplate what mode of

production might follow the decline and fall of fossil fuels, unless

the industrial system becomes truly sustainable.